From the intricate World wide web of global Electrical power markets, Electrical power traders serve as pivotal gamers, ensuring the seamless stream of Power commodities from producers to people. Their knowledge in examining market developments, running hazards, and executing strategic trades is very important for sustaining current market stability and meeting the ever-evolving Electricity demands.

Precisely what is an Energy Trader?

An Vitality trader is often a finance professional who buys and sells Vitality commodities for example energy, all-natural gas, oil, and renewable Vitality credits. They run in several marketplaces, together with location, futures, and derivatives, aiming to capitalize on price fluctuations and supply-demand dynamics. Their decisions are informed by a multitude of elements, such as climate patterns, geopolitical occasions, and regulatory adjustments.

Crucial Duties of an Power Trader

Marketplace Evaluation: Power traders continuously monitor global marketplaces to establish tendencies and chances. They evaluate information associated with source and demand from customers, weather conditions forecasts, and geopolitical developments to produce informed investing choices.

Danger Administration: Presented the volatility of Vitality marketplaces, traders make use of different methods to hedge versus probable losses. This contains the use of monetary instruments like futures and options to mitigate possibility.

Portfolio Management: They regulate a portfolio of Strength assets, generating decisions on obtaining, offering, or Keeping positions to maximize profitability.

Regulatory Compliance: Electricity traders should make sure all buying and selling things to do comply with suitable regulations and visit site restrictions, maintaining transparency and ethical benchmarks.

Collaboration: They perform intently with analysts, risk professionals, and other stakeholders to align buying and selling tactics with organizational goals.

Capabilities and Skills

Instructional Background: A bachelor's degree in finance, economics, engineering, or possibly a linked field is typically necessary. State-of-the-art levels or certifications find out here can enhance profession prospective clients.

Analytical Competencies: Powerful quantitative skills are essential for interpreting intricate facts and building swift conclusions.

Interaction: Helpful interaction skills are essential for negotiating deals and collaborating with team users.

Technological Proficiency: Familiarity with investing platforms, economical modeling applications, and facts Investigation program is very important.

Adaptability: The Electrical power current market is motivated by quite Renewable energy trading a few unpredictable aspects; Hence, traders should be adaptable and resilient.

Kinds of Energy Investing

Bodily Trading: Will involve the article particular getting and promoting of Electrical power commodities, necessitating logistical coordination for shipping and delivery.

Financial Investing: Focuses on investing contracts and derivatives that depict Power commodities, allowing traders to invest on cost actions without having managing the Bodily merchandise.

Occupation Route and Chances

Energy traders can discover work in a variety of sectors, including utility corporations, investment decision banking companies, commodity trading companies, and energy producers. With knowledge, traders can progress to senior roles including investing desk supervisor, portfolio manager, or chance administration director.

Summary

The part of the energy trader is integral for the operating of worldwide Power markets. By leveraging analytical techniques, marketplace expertise, and strategic wondering, Power traders contribute on the economical distribution and pricing of energy sources. Since the Electricity sector proceeds to evolve, particularly Using the rise of renewable Vitality sources, the need for expert Electricity traders is poised to mature, featuring exciting possibilities for specialists On this discipline.

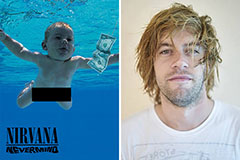

Spencer Elden Then & Now!

Spencer Elden Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Brandy Then & Now!

Brandy Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now!